S&P Global Platts launches carbon intensity calculations

S&P Global Platts is launching the first daily carbon offset premiums alongside monthly carbon intensity calculations for 14 major crude fields globally from October 1.

The marginal carbon intensity (CI) calculations for different oil fields will help producers, investors, shareholders and downstream purchasers better understand the emission attributes of the crude where over time the carbon intensity of the production process can become its own attribute of the crude itself, like the density of the crude and how much sulfur is included.

Increased scrutiny of the upstream carbon intensity associated with the production of fossil fuels has led to investors, consumers and producers looking to reduce their carbon footprint or emissions, which has resulted in a growing demand for "low-carbon crude".

Calculating the carbon intensity of different commodities has become one of the ways the market has started to measure GHG emissions from specific types of production. Oil produced with a lower amount of GHG emissions has a lower carbon intensity than crudes produced with higher emissions.

In turn, crudes that are produced with a higher volume of GHG emissions have a higher carbon intensity, and high CI crudes will carry a greater carbon intensity premium and require a greater volume of voluntary carbon credits to offset emissions than crudes with a lower CI.

Deb Ryan, Head of Low Carbon Market Analytics at S&P Global Platts, said oil and gas will remain part of the energy mix for decades to come, and in order for the world to meet ambitious emissions reduction targets, a premium value needs to be associated with the lowest carbon intensity oil and gas assets as these fossil fuels continue to play a role in the overall energy mix.

"By launching carbon intensity values and price premiums, Platts is bringing much needed transparency into the market. Awareness of carbon intensity values – while working in tandem with carbon markets, both voluntary and compliance-based, will accelerate investments into projects that will reduce or avoid greenhouse gas emissions for the future," she said.

Paula VanLaningham, Global Head of Carbon at S&P Global Platts, said interest from the market on carbon intensity, and recent trades to account for carbon emissions are important steps in the right direction.

"Calculating carbon intensity for oil fields allows a greater understanding of the respective carbon footprint, which enables market participants to focus on utilising the lowest carbon assets," she said. "Significantly reducing emissions generated from the oil and gas industry is critical to mitigating the effects of climate change. Our new upstream carbon intensity calculations provide new transparency in an important first step to drive further evolution in this area."

From October 1, Platts will begin publishing

- monthly assessments of crude oil field carbon intensity in kilograms of carbon dioxide equivalent per barrel of oil equivalent (kgCO2e/boe);

- monthly assessments of transportation carbon intensity along one relevant route per crude in kilograms of carbon dioxide equivalent per barrel (KgCO2e/b);

- and daily assessments in $/boe and $/b respectively using the daily Platts Carbon Removal Credit (CRC) voluntary carbon credit assessment.

Platts' upstream carbon intensity calculation measures the impact of GHG from well production to the storage terminal, and is designed to reflect the value of upstream production carbon intensity for a specific crude grade coming from an oil field.

Platts looks at production, flaring and venting, maintenance activities, production processing and transport to the storage hub to identify the main sources of emissions, relevant to specific operations. Emissions generated during the exploration and drilling stages are currently not included as part of the Platts upstream CI calculation.

It uses proprietary research and analysis to calculate results, with the Oil Production Greenhouse Gas Emissions Estimator (OPGEE) 3.0 model as the foundation.

Platts' midstream carbon intensity calculation measures the carbon intensity for one transport route per crude from the storage terminal to the most likely refining hub.

Platts Carbon Intensity Premiums are calculated in $/boe and $/b respectively, with the value of the CI premium calculated using the daily Platts Carbon Removal Credit Assessment (Platts CRC).

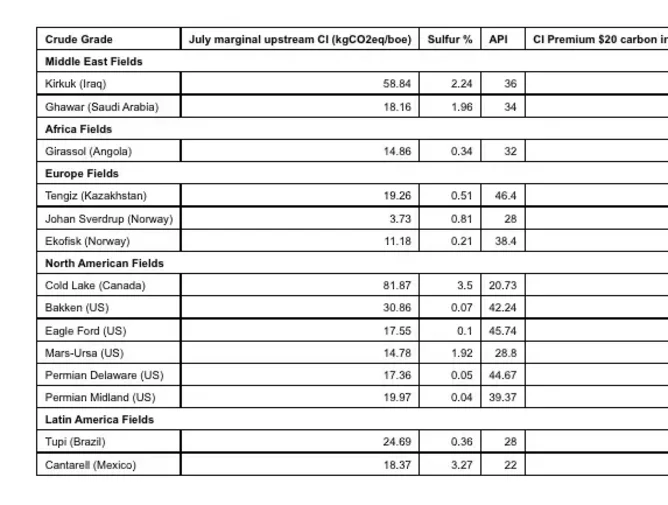

The table below shows the carbon intensity (CI) for each field included in this release. This allows each field to be compared, where high CI represents higher emissions per volume of oil produced. For example, the Midland Basin in the Permian has a high carbon intensity, hence higher emissions than the Delaware Basin in the Permian.

The CI premium is the premium that a buyer would pay to offset the GHG emissions generated through the production of each crude. The $20 carbon price represents reforestation with a high number of associated co-benefits, while the $50 carbon price moving closer to tech-based carbon credit pricing, which includes CCUS.