Why U.S. solar power market will shine brightly by 2020

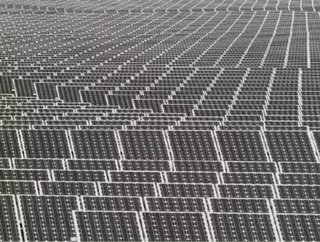

According to Bloomberg New Energy Finance, the U.S. solar market is expected to see some serious. growth over the next decade. The reason? The reasons are declining equipment costs and stronger government support. The leading researcher and analysis provider in the clean energy and carbon markets believes that solar powered generating capacity, through the use of photovoltaic and solar thermal electricity technologies, could reach just over four percent of the nation’s power capacity by 2020. That percentage is dependent upon the industry’s capability for attracting an investment of around $100 billion.

The U.S. currently has only 1.4 gigawatts of installed solar power capacity, placing it fifth in the world. That number has the potential to jump to 44 gigawatts by the year 2020, according to Bloomberg New Energy Finance. In a new report issued by the company, forecast capacity from large-scale solar thermal projects is due to rise from 0.4 gigawatts to 14 gigawatts by 2020. In photovoltaics, the group expects a 34 percent annual growth rate to 30 gigawatts by 2020.

“Policy, rather than sunshine, will remain the U.S.’s greatest solar resource for the next few years," said Milo Sjardin, Bloomberg New Energy Finance’s U.S. head of research. "By the middle of this decade, however, the U.S. retail solar market will be driven by fundamental, unsubsidized competition, which should transform the U.S. into one of the world’s most dynamic solar markets.”

Michael Liebreich, chief executive of Bloomberg New Energy Finance said: “There is a very positive growth story for solar in the U.S.: a few more years of support, and then the engine of unsubsidized competitiveness will take over – and the world will never be the same. The important thing right now is to ensure policy stability, to give investors confidence during this critical period. The U.S. solar industry will require private sector investment of $100bn during the next decade, and any hint that the government’s commitment to clean energy could waver and investors will run for cover.”

The analysis quoted in this release is from a recently published report by Bloomberg New Energy Finance entitled “Quantifying the U.S. solar market: system returns and new build projections”.