CCUS projects are 'a drop in the ocean' with economic issues

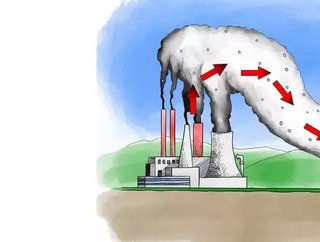

Carbon capture, utilization, and storage (CCUS) projects are 'a drop in the ocean' compared with global CO2 emissions, according to an IDXTech Ex report.

Plans for more than 30 new CCUS facilities have been announced since 2017 and even if all these projects proceed, global capture capacity would triple to around 130-140 million tonnes per year - while global CO2 emissions topped 36 billion tonnes in 2019.

A common challenge facing all aspects of the industry is that of economics, the report states.

Although separation is fairly straightforward for waste streams with high concentrations of CO2, such as in natural gas processing or ammonia production, it becomes costlier as the relative amount of CO2 in the stream decreases.

Capturing one tonne of CO2 from a flue gas stream in an average coal-fired power plant currently costs around $40-80. Capturing CO2 directly from the atmosphere can cost around $600. The energy requirements to capture the CO2 are also an issue – a coal plant equipped with CO2 capturing equipment can require about 25% more fuel to generate the same amount of power as one without it.

Once the carbon has been captured, there's the challenge of what to do with it. Captured CO2 can either be stored underground or utilized for various industrial applications.

Underground storage is by far the most widely used option, with most industrial-scale CCUS facilities using captured CO2 for enhanced oil recovery (EOR), where CO2 is injected into oil wells to boost productivity, the report adds. 'This is somewhat problematic in its own sense, as it is essentially using CO2 to access more oil which will then be burned to give out CO2, but it also requires high oil prices to be commercially viable,' it states.

The drop in oil prices stemming from the COVID-19 pandemic made EOR less viable in 2020, resulting in the Petra Nova facility's closure in Texas, which was the world's largest installation of CO2 capture on a power plant.

Carbon pricing schemes and tax credits such as the 45Q scheme in the US can help make CO2 storage more viable, although such schemes are still in their early stages across much of the world. The Australian Government recently launched an AUD$50 million (£27.7m) initiative to support CCUS technologies.

In the UK, bp, Eni, Equinor, National Grid, Shell and Total teamed up to form the Northern Endurance Partnership (NEP) to develop offshore Carbon Capture, Utilisation and Storage (CCUS) infrastructure in the North Sea. But the project, announced last October (click here), is at least five years away.

With bp as operator, the infrastructure - which could cut UK industrial emissions in half and store millions of tonnes of CO2 - will serve the proposed Net Zero Teesside (NZT) and Zero Carbon Humber (ZCH) projects that aim to establish decarbonized industrial clusters in Teesside and Humberside.

The UK government has allocated £8 million in funding for projects in the West Midlands, North West, Scotland and South Wales too, in a bid to cut carbon emissions from major industrial areas.

While CCUS technology is projected to play only a minor role in the sector’s overall decarbonization, O&G players can still significantly influence its adoption and development, according to McKinsey. Total CCUS capacity could increase by as much as 200 times by 2050.

CCUS technologies should not be dismissed as "too expensive", according to an IEA paper. The relative lack of progress in deploying CCUS to date means that many technologies and applications are still at an early stage of commercialisation – and therefore at a high point in the cost curve.

"There is ample potential for cost reductions – the experience of wind and solar highlights what is possible – but, as with renewable energy, realising this potential will require strengthened policy support to drive CCUS innovation and deployment," write energy analysts Adam Baylin-Stern and Niels Berghout.

"The development of economic stimulus packages in response to the Covid‑19‑related economic downturn presents a unique opportunity to boost investment in CCUS and support a least-cost pathway to net zero."