McKinsey: aggregate fossil fuel demand to peak in 2027

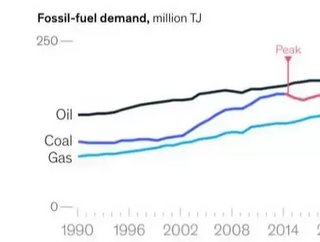

Aggregate fossil fuel demand is set to peak in 2027 – with oil peaking in 2029 and gas in 2037 – partially due to the impacts of COVID-19, according to new research by McKinsey & Company.

The Global Energy Perspective 2021 report finds that while coal demand peaked already, peaks in demand for oil and gas are not far behind.

The pandemic has resulted in a profound reduction in energy demand, from which McKinsey expects it will take between one to four years to recover – with electricity and gas demand expected to bounce back more quickly than oil demand.

However, demand for fossil fuels will never return to its pre-pandemic growth curve. Over the long-term, the impacts of behavioural shifts due to COVID-19 are minor compared to “known” long-term shifts such as decreasing car ownership, growing fuel efficiencies and a trend towards electric vehicles, whose impact is estimated to be three-to-nine times higher than the pandemic’s by 2050.

Christer Tryggestad, Senior Partner at McKinsey, says: “While the pandemic has certainly provided a substantial shock for the energy sector across all fuel sources, the story of the century is still a rapid and continuous shift to lower-carbon energy systems”.

“The share of electricity in the energy mix is set to grow by around 50 percent by 2050 and it’s set to capture all global energy growth as hydrocarbon consumption plateaus. However, in our Reference case, fossil fuels continue to play a significant role for the foreseeable future.”

Key findings

- Power consumption to more than double by 2050 as energy demand electrifies

- Green hydrogen will become cost competitive by 2030 - a game changer for the sector

- Low-cost renewables will dominate the power market by 2030 as they become cheaper than existing fossil plants

- Almost half of global capacity will be in solar and wind by 2035

Indeed, while energy systems around the world will shift to renewables, which are able to compete with the marginal cost of fossil power already today in most places, by 2050 more than half of all global energy demand continues to be met by fossil fuels in McKinsey’s Reference Case scenario.

As a result, while the earlier peak of hydrocarbon demand means a substantial reduction in forecasted carbon emissions, the world remains significantly off of the 1.5ºC pathway and will run out of its carbon budget for 2100 in the early 2030s.

Tryggestad concludes: “There is still a long way to go to avert substantial global climate change. According to our estimates, annual emissions would need to be around 50 per cent lower in 2030 and about 85 per cent lower by 2050 than current trends predict to limit the global temperature increase to 1.5ºC”.

“The importance of policies has increased in the past year. Despite the increased momentum towards decarbonization, many governments still need to translate ambitious targets into specific actions. Additionally, given the unparalleled size of many economic recovery packages post COVID-19, the focus of the stimulus measures will play a key role in shaping energy systems in the decades to come.”

The findings are taken from four scenario outlooks, conceived by McKinsey:

- 1.5ºC Pathway McKinsey’s top-down view of how a pathway that limits global warming to 1.5ºC could look across sectors and energy products, taking economic and technical feasibility into consideration

- Accelerated transition A progressive view, driven by governmental response to COVID-19 and “next normal” behavioural changes. This scenario assesses the impact of 10 conceivable shifts happening at an accelerated pace (e.g., uptake of EVs, recycling, renewables and hydrogen)

- Reference case McKinsey’s outlook on the continuation of existing trends. This scenario reflects our expectations of how current technologies can evolve and incorporates current policies and an extrapolation of key policy trends

- Delayed transition Post-pandemic, the societal focus is on economic recovery; energy transition continues at a lower speed; lower incentives to invest in decarbonization technologies, and low fossil fuel prices delay cost parity

The report presents specific outlooks per fuel type such as natural gas, oil, coal and hydrogen. It also discusses carbon emissions and offers a detailed perspective on the McKinsey 1.5ºC pathway. This includes a look at the implications for business leaders and policy makers, comprising a view on value pools and an energy investment outlook.