Shell cuts Scope 1, 2 and methane emissions

Shell today published its first Energy Transition Progress Report detailing emissions developments over the past five years.

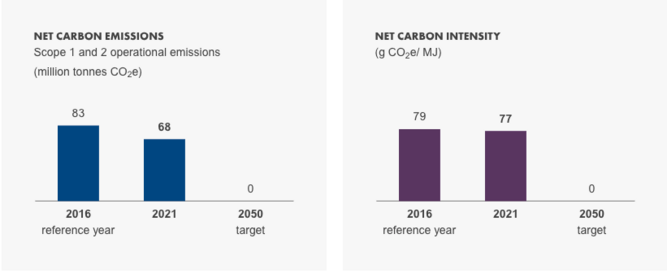

By the end of 2021, it reduced Scope 1 and 2 emissions under its operational control to 68mn tonnes of CO2e, and cut total methane emissions from operations by 18% to 55,000 tonnes, compared with 67,000 tonnes in 2020.

While progress has been made with net carbon emissions - down from 83mn tonnes of CO2e from the 2016 reference year - net carbon intensity has only decreased slightly from 79g CO2e/MJ in 2016 to 77g CO2e/MJ in 2021.

Routine flaring from Upstream operations fell to 0.2mn tonnes of hydrocarbons, marginally down from 0.3mn tonnes of hydrocarbons in the previous year. However overall flaring increased from 0.8mn tonnes of hydrocarbons to 1mn tonnes because of non-routine flaring, mainly as a result of operational issues in Nigeria.

“In a time of great uncertainty, it is vital that our long-term energy transition strategy remains on track,” said Ben van Beurden, Shell’s CEO. “This report shows the strong progress we have made towards our target to become a net-zero emissions energy business by 2050.”

Shell has identified three key areas to accelerate the energy transition.

Increase investments in Marketing and Renewables and Energy Solutions, with expected returns of 15-25% and more than 10% respectively. These businesses include service stations, sales of gasoline and diesel, fuels for business customers, power, hydrogen, biofuels, charging for electric vehicles, nature-based solutions, and CCUS.

Maintain investments in Integrated Gas and Chemicals and Products businesses, with expected returns of 10-15% and 14-18% respectively. This division sells the products needed to enable the energy transition, and produce sustainable cash flows and asset infrastructure to support investments in low-carbon businesses.

The third goal is to limit investments in Upstream oil and gas business, with expected returns of 20-25%.

Last year, the company set a new target to reduce absolute emissions from its operations and the energy it uses to run them by 50% by 2030, compared with 2016 on a net basis. By the end of 2021, Shell had made a reduction of 18%. The company is now working towards a 9-12% reduction in net carbon intensity by 2024, and a 20% reduction by 2030, both compared with 2016.

“We are helping our customers to identify and use low- and zero-carbon alternatives to the energy products they have used for many decades,” said Andrew Mackenzie, Shell Chair. “We see great business opportunities for Shell in the fast-growing low- and zero-carbon markets where we are well positioned to provide the different products and solutions our customers need.”

In 2021, its cash capital expenditure was $20bn and operating expenses were $36bn.