IEA warns of mineral supply and climate ambitions 'mismatch'

An accelerated energy transition could quickly see demand running ahead of supply and create a 'looming mismatch' of mineral supply and climate ambitions, according to a new International Energy Agency (IEA) report.

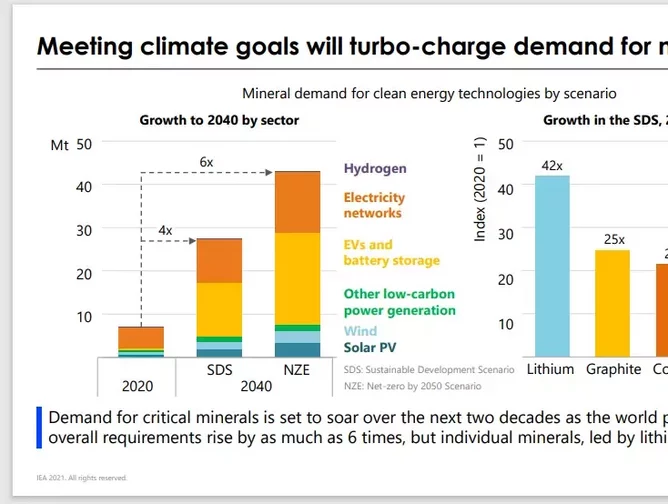

The Role of Critical Minerals in Clean Energy Transitions states that while there is no shortage of mineral resources, recent price rises for cobalt, copper, lithium and nickel show how supply could struggle to keep pace with the world’s climate ambitions and overall requirements could rise as much as six-fold by 2040.

It highlights how clean energy technologies need significantly more minerals, notably:

- Lithium, nickel, cobalt, manganese and graphite for batteries

- Rare earth elements for wind turbines and electric vehicles motors

- Copper, silicon and silver for solar PV

- Copper and aluminium for electricity network

The report illustrates the complexities surrounding clean and 'green' technologies. A typical electric car requires six times the mineral inputs of a conventional car - although on average, the full lifecycle emissions of an EV bought today are around half those of a conventional car - and an offshore wind plant requires thirteen times more mineral resources than a similarly sized gas-fired power plant.

Many mineral supply chains lack diversity, the report notes. Production and processing of lithium, cobalt and some rare earth elements are geographically concentrated, with the top three producers accounting for more than 75% of supplies.

Recycling will become a significant source of supply, and by 2040, recycled quantities of copper, lithium, nickel and cobalt from spent batteries could reduce combined primary supply requirements for these minerals by around 10%.

The IEA recommends six courses of action: ensure adequate investment in diversified sources of supply; promote technology innovation at all points along the value chain; scale up recycling; enhance supply chain resilience and market transparency; mainstream higher environmental, social and governance standards; and strengthen international collaboration between producers and consumers.

During the last five decades, the global use of materials has more than tripled, from 26.7 billion tonnes in 1970, to 92 billion tonnes in 2017, according to the Circularity Gap Report 2020.