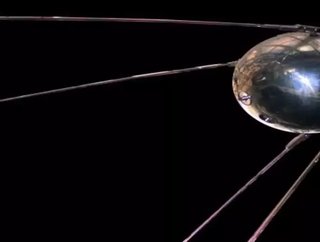

"Sputnik" Era Upon Us, Steven Chu Estimates

We’re in a new “Sputnik” era according to U.S Energy Secretary Steven Chu, who spoke yesterday about the success of China’s clean energy industries and the potential for the United States to emerge in a new “Sputnick Moment.”

"When it comes to innovation, Americans don't take a back seat to anyone - and we certainly won't start now," said Secretary Chu. "From wind power to nuclear reactors to high speed rail, China and other countries are moving aggressively to capture the lead. Given that challenge, and given the enormous economic opportunities in clean energy, it's time for America to do what we do best: innovate. As President Obama has said, we should not, cannot, and will not play for second place."

Chu outlined a series of clean energy innovation efforts to jumpstart the “Sputnik” revolution, including the Recovery Act funded electric vehicle batteries at 500 miles on a single charge and a project established by the Energy Innovation Hub led by the California Institute of Technology for converting sunlight into usable fuel.

In risk of faltering behind China and other countries, Chu recommended the United States begin focusing on improving the work within high voltage transmission, high speed rail, advanced coal technologies, nuclear power, alternative energy vehicles, renewable energy and supercomputing. While China has been advancing in the last few years with scientific partnerships and global testing, Chu stressed the importance of continuing innovation while focusing on keeping all program local. As China continues to invest in clean energy technologies, so too will the United States, estimates Chu, with 17 National Labs and leading scientific and computing resources already established via the Department of Energy.