Vermilion Energy completes Leucrotta Exploration acquisition

International energy producer Vermilion Energy has closed the acquisition of Leucrotta Exploration.

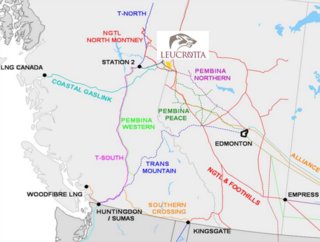

The primary asset acquired is the Mica property, comprised of 81,000 gross (77,000 net) contiguous acres of Montney mineral rights in the Peace River Arch straddling the Alberta and British Columbia borders. The acquisition was announced on March 28.

The aggregate consideration of the newly formed Montney company will be around $500mn.

Vermilion has conservatively identified 275 multi-zone, extended reach, drilling prospects to date, representing an expected "two decades or more" of low-risk, self-funding, high-deliverability drilling inventory with strong rates of return.

Over the past two months since time of deal announcement, North American gas prices have strengthened, as illustrated by the 35% increase to 2023 AECO strip further reinforcing the profitability of the Mica property.

"We believe there is meaningful upside in other zones, which could add significant inventory to this land base and the optionality for cube development," it said in a statement. "The multi-zone development nature of these assets is a natural extension of the multi-zone development that our Canadian Business Unit has been focused on in West Central Alberta for over a decade.

"Integrating these assets into our Canadian asset base allows us to high-grade our North American portfolio and is expected to add decades of inventory while continuing to develop and grow our international portfolio with the goal of maximising free cash flow for shareholders over the near and long-term."

Leucrotta believes Vermilion is well capitalised and better suited to deliver surface value sooner on the Mica and Alberta Projects than Leucrotta will, and Vermilion has shared some of that upside in their offer to the mutual benefit of both parties. The Arrangement will also permit the ExploreCo lands to be capitalised faster than previously planned, benefitting Leucrotta’s shareholders as a result of the lands’ accelerated development.

Leucrotta recently completed gas processing and battery funding agreements with NorthRiver Midstream and announced it had increased production 63% from 2,695 boe/d in Q1 2021 to 4,384 boe/d in Q1 2022.

Increased adjusted funds flow soared 194% from $3.8mn in Q1 2021 to $11.2mn in Q1 2022, leading to adjusted working capital balance of $33.2mn by March 31.

Vermilion's operations are focused on the exploitation of light oil and liquids-rich natural gas conventional resource plays in North America and the exploration and development of conventional natural gas and oil opportunities in Europe and Australia.

It trades on the Toronto Stock Exchange and the New York Stock Exchange under the symbol VET.