Investment partnerships provide supply securities

More high-profile tie ups are emerging in the energy renewables space as companies seek supplies security amid economic and environmental uncertainty.

On Monday LG Energy Solution secured 100% rights to battery-grade nickel and cobalt materials from Australian Mines and now Glencore has entered a long-term strategic partnership with Britishvolt, the UK EV battery manufacturer.

By securing one of the key battery ingredients from the Glencore cobalt brands, Britishvolt is "significantly derisking its operation" by obtaining long-term security of supply across its business, claims Glencore.

David Brocas, Head Cobalt Trader, Glencore, said: "Our commitment to support our partners in meeting their requirements for essential battery ingredients is key to underpinning long-term supply agreements. As the mobility and energy transition accelerates, so does future demand for battery metals such as cobalt, copper and nickel. Glencore is already a leading producer and supplier of these metals, helping to underpin our ambition of achieving net zero total emissions by 2050."

Orral Nadjari, Britishvolt CEO/Founder, confirmed that by partnering with Glencore, it is locking in supply and derisking the project. “Cobalt is a key ingredient in electric vehicle batteries and knowing that we are being supplied with ethically produced, low-carbon cobalt is a signal to the market that we are living by our values," he said.

Britishvolt is on target to manufacture some of the world’s most sustainable, low carbon battery cells on the site of the former Blyth Power Station coal stocking yard located in Cambois, Northumberland. The project will be built in three phases each of 10GWh to a total capacity of 30GWh by end-2027 onwards.

In June, the company entered into a non-binding MoU with ENTEK Membranes for the possible supply of battery separators, with an objective to colocate as the lithium-ion Gigaplant manufacturing facility scales up to full production.

Elsewhere mPLUS CORP, the secondary battery manufacturing process machine suppliers, has signed an MoU with Digital Industries (DI) at Siemens Korea for collaboration in the battery industry. It will be an advanced collaboration for complete automation of equipment and production plants.

Rainer Brehm, CEO of Siemens DI FA (Digital industries Factory automation), visited mPLUS head office last month to have collaboration discussion with Jongsung Kim, the CEO of mPLUS, and the management team. They mutually agreed on the "higher-level technical cooperations".

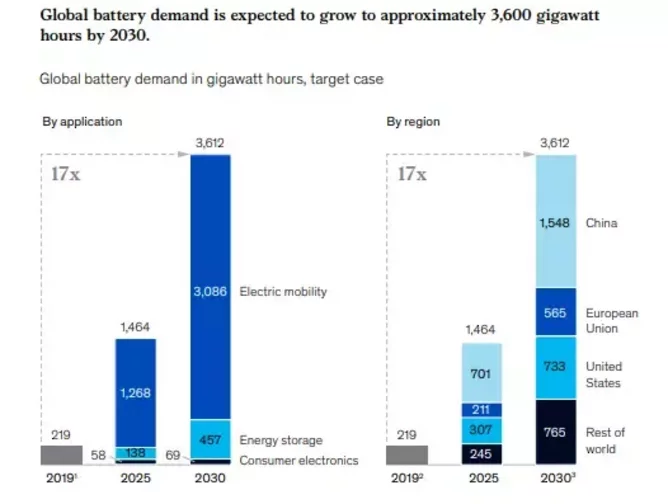

McKinsey expects demand for lithium-ion batteries will grow to more than 3,500 gigawatt hours (GWh) by 2030, from about 220 GWh in 2019.

In this high-growth target scenario, 120 new large-scale factories would be needed to produce battery cells. The required raw-material inputs would increase up to 40 times, depending on the mineral used, and production of the active materials in battery cells would rise nearly 15-fold.