Total awards Donges FEED contract to Amec Foster Wheeler

Amec Foster Wheeler has been awarded a Front-End Engineering Design (FEED) contract by Total Raffinage France, a subsidiary of Total, the French multinational integrated oil and gas company.

Total has stated that the Donges refinery currently lacks desulphurisation capacity, and a significant proportion of its fuels are therefore exported because they no longer meet fuel quality European Union specifications.

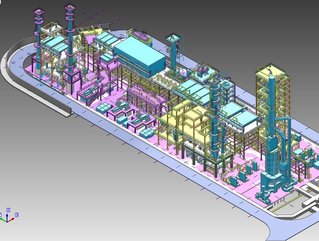

The project, comprising a new vacuum gas oil hydrotreater unit and sour water stripping unit as well as modification of existing units and new interconnections, is part of the investment planned by Total to upgrade its Donges refinery, improving its performance.

Amec Foster Wheeler will support the modernisation of Total Raffinage’s Donges refinery in Western France by combining its world-class refinery FEED expertise, integrated engineering systems capabilities and its innovative Asset Information Hub (AIH) with the visualisation and digital asset Virtual Plant technology.

SEE ALSO:

-

Total awarded multi-billion dollar contract to work on Iran's South Pars project

-

New technology enables action on CO2 emissions in the oil & gas Industry

Marco Moresco, Amec Foster Wheeler’s president of Downstream Capital Projects Europe, Middle East and Africa, said: “This is a strategically important project for Total designed to increase the performance of the Donges refinery, which Amec Foster Wheeler knows well from past successful projects.

“We will combine innovative Virtual Plant technology and our unique Asset Information Hub, together with our extensive refinery clean fuels expertise, to deliver this important project for Total.

“Amec Foster Wheeler has enjoyed a long and successful relationship with Total, including studies, FEEDs and engineering, procurement and construction management projects.”

The AIH provides a digital representation of the physical plant. Collating documents, data, and models of the plant, the AIH is a powerful information management system with which to control and review aspects of the plant throughout its life in a secure environment.

Combined with Virtual Plant technology, provided by Aveva, it allows a designer to move around an asset, zoom in, open documents and review data that is hosted in the AIH.

Amec Foster Wheeler is currently the only company licenced by Aveva to provide this hosting service.

The project will be delivered in the final quarter of 2017.