Shell posts $11.5bn second quarter profit

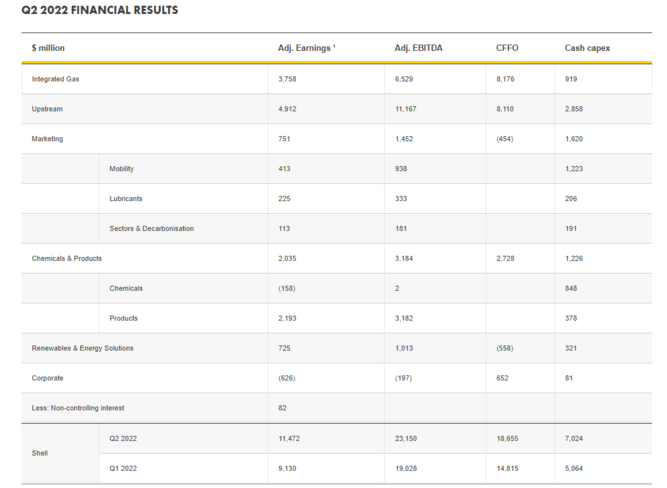

Shell overcame a turbulent economic environment to post a near $11.5bn profit in Q2 - up from $9.1bn in Q1 - as it continued to benefit from rocketing energy prices, supply constraints and ongoing geopolitical instability from the Ukraine war.

The combination of macro political and economic factors produced strong performances across the board, particularly in refining margins - with Upstream reporting adjusted EBITDA of $11.1bn - and stronger gas and power trading and volatility, especially in North America, Europe and Australia.

The energy major said it is strengthening energy security through natural gas investments in Pierce and Jackdaw (UK), and participation in the North Field LNG expansion (Qatar) and Crux FID (Australia). It announced its $6bn share buybacks are expected to be completed by Q3 2022 results, and in the first half of 2022, shareholder distributions have doubled from those in the first half of 2013.

Shell CEO Ben van Beurden said with volatile energy markets and the ongoing need for action to tackle climate change, 2022 continues to present huge challenges for consumers, governments, and companies alike.

"Consequently, we are using our financial strength to invest in secure energy supplies which the world needs today, taking real, bold steps to cut carbon emissions, and transforming our company for a low-carbon energy future," he said.

"And, crucially, our Powering Progress strategy is delivering strong results for our shareholders on the back of years of portfolio high grading, combined with robust operational performance."

In the renewables space, it is progressing with the acquisition of Sprng Energy group, one of India’s leading renewable power platforms (click here) and signed 10-year renewable energy supply agreement with Air Liquide to provide 52GWh of solar energy per year to power industrial and medical gas production operations in Italy (click here).

Shell Nederland and Shell Overseas Investments recently took the final investment decision to build Holland Hydrogen I, which will be Europe’s largest renewable hydrogen plant once operational in 2025 (click here).

Shell has also been selected by QatarEnergy as a partner in the North Field East expansion project in Qatar, which is billed as the single largest project in the history of the LNG industry (click here).

BG International, an affiliate of Shell UK, recently took the final investment decision to develop the Jackdaw gas field in the UK North Sea, following regulatory approval earlier this year and the UK government granting a permit last month (click here). Peak production from the field is estimated at 40,000 barrels of oil equivalent per day.